If you do not know that China’s motorcycles are beginning to dominate or have already dominated certain markets, then we say, “Welcome home” from your travels through the multiverse. China has been a global manufacturing powerhouse for more than 20 years now, and riding this wave is their automotive industry.

History

Motorcycle manufacture in China first began in 1951, when the People’s Liberation Army began producing a 500cc motorcycle to meet the country’s military requirements during the Korean War. It was developed on the lines of the K500, a German model used in World War II.

Before the end of the 1970s, motorcycles produced in China were mainly used by the military services. However, the Beijing Motorcycle Factory, produced motorcycles for the general public that were based on the German pre-war BMW R71, and Russian Ural and Dnepr (in turn, based on the R71) from 1958 onwards.

In 1979, in Chongqing city, military munitions factory China Jialing Industrial Company began to independently manufacture motorcycles for civilian use, ushering in the modern era of Chinese motorcycle production. In 2000, the Chinese industry took over as the biggest motorcycle producer in the world, a position that it has maintained.

Manufacturing: The World’s Motorcycle Factory

China’s manufacturing scale is immense. In 2023, the country produced over 18.3 million motorcycles. Driven by strong domestic and international demand, production is projected to reach close to 20 million units in 2024 and maintain this upward trajectory into 2025.

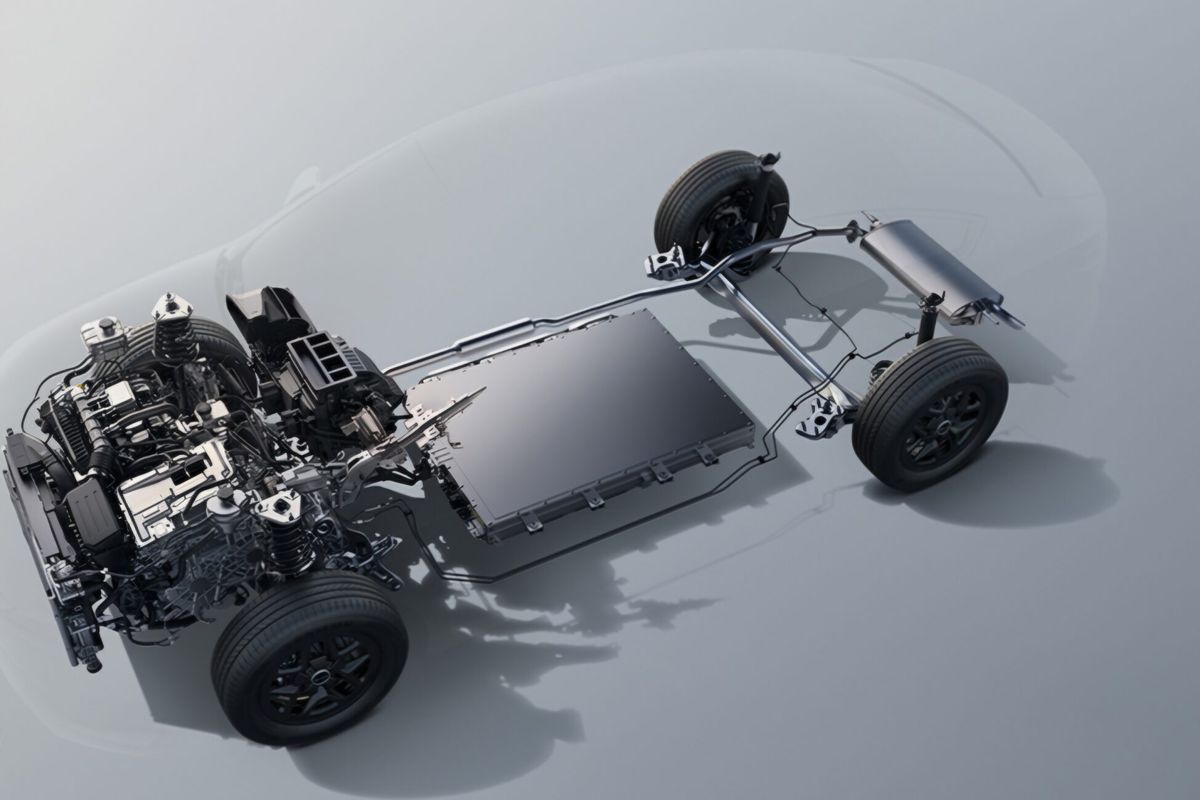

A key feature of this output is the clear split between traditional and electric models. While gasoline engines remain important for export, a massive and growing portion of production is dedicated to electric two-wheelers, cementing China’s status as the global hub for both segments.

Domestic Sales: The Electric Kingdom

Within China, the story is overwhelmingly electric. The domestic market is fueled by affordable, convenient electric scooters and light motorcycles. These vehicles are not for recreation but are essential tools for daily life, serving as the primary mode of transport for millions of commuters and the backbone of the country’s vast delivery and logistics networks.

Sales figures closely mirror production, with tens of millions of units sold annually. The demand for electric models continues to surge, driven by urban mobility needs, supportive government policies for EVs, and a well-established charging infrastructure.

Exports: Conquering the World on Two Wheels

China is also the world’s top exporter. In 2023, it shipped 8.83 million motorcycles abroad. Data from the first half of 2024 shows an 11% increase, putting the country on track to export over 9.5 million units for the full year (the 2024 figures are not confirmed yet). This momentum is expected to continue, with annual exports projected to reach 11-12 million units by 2026.

These exports serve two distinct global markets:

-

Gasoline for Developing Economies: Reliable, low-cost motorcycles are shipped in huge numbers to countries across Asia, Africa, and Latin America for everyday transport.

-

Electric for Developed Markets: Exports of electric scooters to Europe and North America are the industry’s fastest-growing segment, with growth rates exceeding 36% as global demand for clean urban mobility explodes.

Top Brands and Manufacturers: The Key Players

There are some 200 motorcycle manufacturers in the country, consisting of a mix of state-owned giants, powerful private firms, and emerging premium brands.

-

Major Electric-Only Brands:

-

Yadea: A global leader in electric two-wheelers, known for its extensive range of scooters and bikes, dominating both the domestic market and international exports.

-

Aima: Another electric vehicle giant, competing directly with Yadea for market share in China and abroad with a focus on innovation and affordability.

-

Niu Technologies: Known for its smart, premium electric scooters with connectivity features, Niu has a strong presence in China and a growing footprint in Western markets.

-

-

Major Gasoline and Mixed Manufacturers:

-

Loncin: A massive manufacturer that produces millions of engines and vehicles annually. It is also a key production partner for international brands like BMW Motorrad.

-

Zongshen Industrial Group: A powerhouse in engine and motorcycle manufacturing, with a strong export business and a growing presence in the electric vehicle sector.

-

Lifan: A long-established player in the industry, producing a wide range of motorcycles, particularly known in export markets.

-

CFMoto: A standout brand that has successfully moved upmarket. CFMoto manufactures high-quality, larger-displacement motorcycles and is a direct competitor to established Japanese and European brands. It also has a renowned partnership with KTM.

-

2025: Smarter, Greener, and More Global

Looking ahead, the Chinese motorcycle industry’s strategy is clear:

-

Moving Upmarket: Brands like CFMoto are leading the charge, showing that Chinese manufacturers can compete on quality and technology, not just price.

-

Smart Technology Integration: Features like app connectivity, advanced battery management, and rider aids will become standard, even on mid-range models.

-

Sustainable Dominance: The global shift towards electrification plays directly into China’s strengths, ensuring its position as the world’s essential source for electric two-wheelers for years to come.

The Road to 2026: Smarter, Connected, and Quality-Focused

The journey through 2026 will be defined by three key trends:

-

Intelligent Connectivity: Motorcycles will become seamlessly integrated into the “Internet of Things.” Expect features like geo-fencing, anti-theft tracking, ride analytics, and over-the-air updates to become standard, even on mid-range models.

-

Brand Building and Premiumization: Chinese manufacturers will continue to shed their budget-image. Following CFMoto’s lead, more brands will invest in R&D to launch premium, high-performance models that compete on a global stage for quality and design.

-

Supply Chain Dominance: China’s control over the battery and EV supply chain will make it the most cost-effective producer of electric two-wheelers, creating a significant and lasting competitive advantage through 2026 and beyond.

In conclusion, the Chinese motorcycle industry is not just maintaining its title as the world’s two-wheeled workshop; it is evolving into its innovation lab. By 2026, it will be recognized as a sophisticated, technology-driven industry that sets the global standard for electric mobility and challenges established players with its own high-quality brands.

Next up: A quick look at the top Chinese motorcycle manufacturers.